A leading global education organization has been pursuing the goal of making knowledge accessible to all for centuries. Over the years, it has served more than 100 million learners worldwide, built one of the most-visited educational platforms globally, and reached over one billion in annual revenue in 2024.

Because the organization reinvests its surplus to further advance its mission, having strong financial controls, accuracy, and efficiency is key. But when you're running an AP team of one, tasked with manually reconciling supplier statements among other AP needs, missed credits and open invoices are inevitable.

Worse yet, not being able to reconcile supplier statements 100% means that the organization was leaving money on the table that could be better used to support its growth initiatives.

Keeping Up With Innovation: Searching for a Better Way to Reconcile Supplier Statements

For most AP teams, manual statement reconciliations are a known source of frustration. It's a task that's easy to deprioritize when you're juggling supplier inquiries and disputes while also ensuring top suppliers are paid on time.

This global education organization was no different.

Its one-person AP team could only reconcile the top 50 suppliers every month before FlexTrap. Driven by its core values for exploring innovative solutions to solve challenging problems, the organization's financial director decided it was time to rethink supplier statement reconciliations.

The financial director set out to find an AP automation solution to streamline the reconciliation process, attending Gartner's annual CFO conference in search of an answer. They eventually found it after meeting FlexTecs at the event and learning about the FlexTrap Statement Reconciliation Module.

Skeptical about the promise of automating statement reconciliations with AI and advanced machine learning (ML) algorithms, the financial director decided to first test the platform with a proof-of-concept (POC) before investing in the payment accuracy platform.

The goal of the POC was to process 12 months' worth of SAP payment data and the top 20 most challenging statements to validate the platform's statement matching engine.

From Skepticism to True Believer: The Power of AI-Driven Statement Matching

The results of the initial output were presented live to the global education organization days after the event. FlexTrap had ingested, matched, and flagged exceptions, open credits, and unpaid invoices faster and more accurately than the organization had expected.

With the proof in hand, the financial director moved quickly to sign the contract, ready to finally resolve their most pressing reconciliation challenges.

Easy, No-Lift Implementation

Most AP automation software falls short during implementation. With FlexTecs, all the financial director had to do was upload the organization's SAP and Open Text data via a secure FlexTrap link and provide the FlexTecs Nepal team with their unique configurations.

Within 30 days, the financial director had a custom instance of FlexTrap Statement Reconciliation with monthly 30-minute check-ins to determine any added needs. The head of global payments even remarked that this has been the most successful AP project they've ever run.

Multiple Formats, One Dashboard to Rule Them All

Supplier statements come in various formats, including PDFs, emails, paper statements, and EDI submissions. Before FlexTrap, the financial director's AP team spent several hours a month consolidating statement data in Excel and using VLOOKUP to match supplier statements with ERP data.

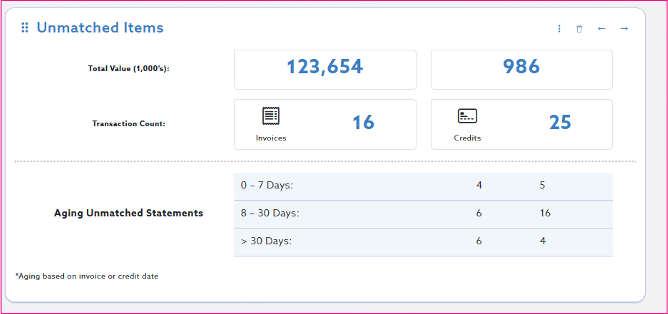

In platform view of unmatched supplier statement dashboard.

AI-enabled data capture, combined with intelligent statement-matching technology, has automated 70% of the process. Now the financial director has greater visibility into key metrics, such as the number of:

-

Supplier statements received

-

Fully matched statements

-

Supplier statements with unmatched items

-

Open invoices and credits (and the financial value of each)

Ongoing Improvements That Scale With Growth

Exceptions are the norm in AP. New suppliers and contract terms often result in changes to statement formats over time. FlexTrap uses a human-in-the-loop model to continually improve the process, with the FlexTecs Nepal team handling unique exceptions, ensuring that the organization's bases are all covered. And because FlexTrap's ML algorithm learns from every exception, the financial director can be confident that future statements are properly reconciled.

Automated Supplier Communications

Supplier outreach and follow-ups created the primary bottleneck for the AP team, leaving room for open invoices, duplicate payments, and unapplied credits to go unnoticed in daily operations. Not anymore.

FlexTrap runs automatic reports, auto sending copies of open supplier credits and invoices to the AP team for immediate processing. It even compiles reconciliation details for all statement items, such as payment status and due dates, keeping suppliers informed and happy while increasing productivity.

From 50 Supplier Statements Reconciled a Month to 201

Before FlexTrap, the financial director was unsure of the number of unpaid invoices in their SAP instance. Within six months, they grew supplier statement coverage four times — with just one person in AP — and the organization is now on track to reconcile more than 400 supplier statements a month.

For the financial director and the global education organization, this is just the beginning.

Now the team wants to discover what additional efficiencies and working capital can be uncovered by exploring the FlexTrap Payment Error Prevention Module. It's not just the benefit of having an extra pair of hands and eyes that interests the organization; it's the promise of reinvesting even more funds into its mission.

Want to advance your mission through smarter AP automation?

See how FlexTrap can help.